Home > Pradhan Mantri Awas Yojana CLSS > Overview

The Pradhan Mantri Awas Yojana (PMAY) was launched by the honourable Prime Minister of India with the mission to fuel the concept of ‘Housing for All’ by 2022. The PMAY has two components, i.e. PMAY(U) for the urban poor and PMAY-G for the rural poor.

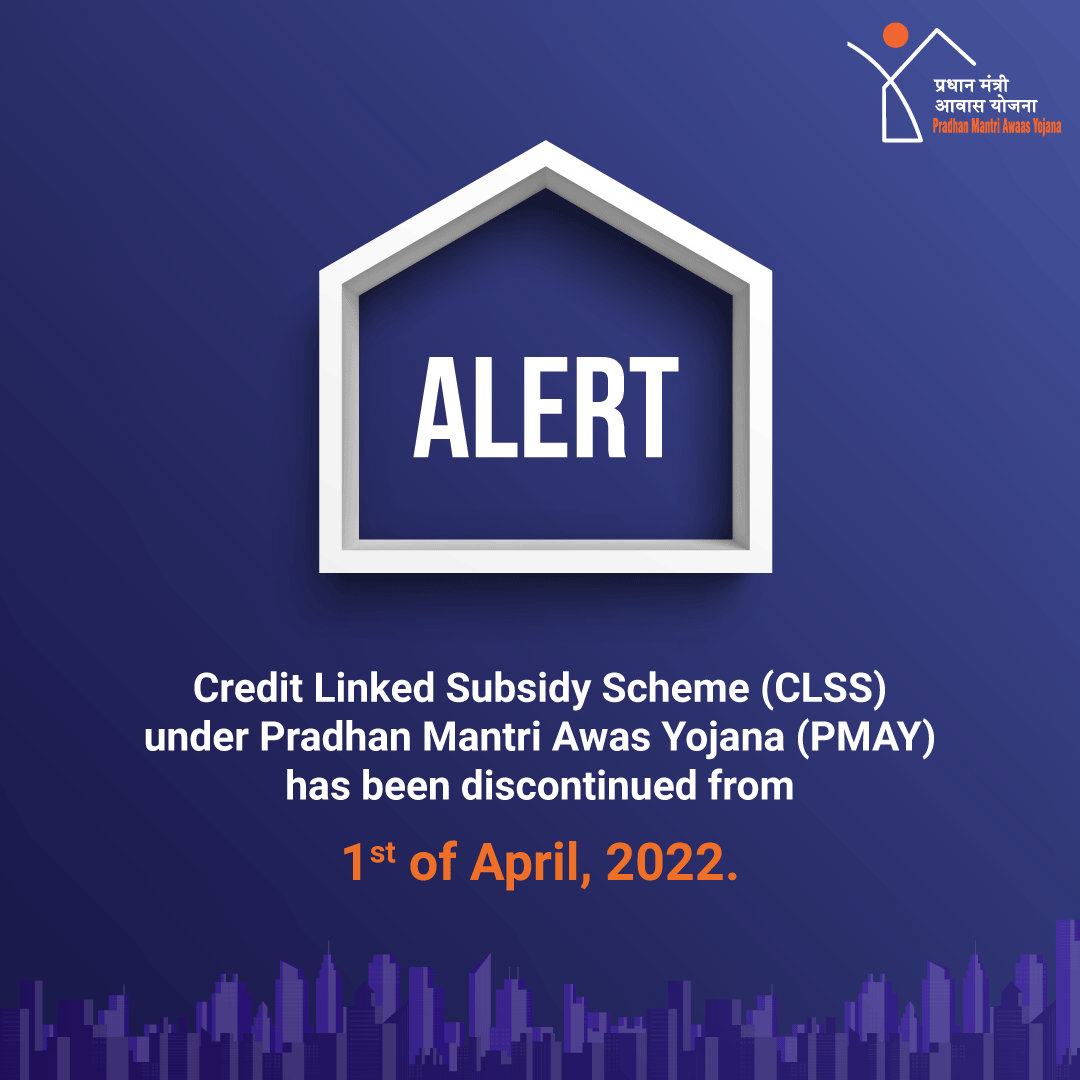

The Pradhan Mantri Awas Yojana (Urban) or PMAY (U) was introduced on 25th June 2015. This is a flagship mission of the government of India implemented by the Ministry of Housing and Urban Affairs (MoHUA). While the scheme was discontinued from April 1st 2022, IIFL Home Finance Ltd. was always at the forefront of facilitation the Credit Linked Subsidy Scheme (CLSS) to the eligible beneficiaries of Economically Weaker Section / Lower Income Group (EWS/LIG) for purchase, construction or enhancement of house. IIFL Home Loan aligns with the Government's vision of ‘Housing For All’ by facilitating financial inclusion for the undeserved communities through its extensive product portfolio. Designed to support the informal income segments, the company provides Home Loans and Secured Business Loans (Loan Against Property) to the first-time homeowners and small business owners, respectively.

Credit Linked Subsidy (PMAY-CLSS) to 55,700+ beneficiaries

1,300+ Subsidy (CLSS) facilitated

151,300+ First time home buyers

54,000+ Loans to informal segment

97,700+ Loans given to women owners / co-owners

Pradhan Mantri Awas Yojana FAQs

- “In-situ” Slum Redevelopment (ISSR)

- Credit Linked Subsidy Scheme (CLSS)

- Affordable Housing in Partnership (AHP)

- Beneficiary-led individual house construction/enhancements (BLC)

- The annual household income of the beneficiary family shall not be more than Rs.3 lakhs and Rs.6 lakhs under EWS/LIG categories, respectively.

- The beneficiary family should not own a pucca house in his/her or in the name of any member of his/her family in any part of India.

- Female ownership/co-ownership in the house is a must.

- The beneficiary family should not have availed of assistance under any housing scheme from the Government of India or any benefit under any scheme in PMAY.

- The house is to be purchased/constructed in a statutory town as notified by the Ministry of Housing & Urban Affairs.

- Step 1: The subsidy is released by the Central Nodal Agency (CNA) based on the disbursement made by Primary Lending Institution (PLI) to the borrower

- Step 2: The subsidy is then credited by CNA to the IIFL Home Loans bank account

- Step 3: IIFL Home Loans credits the subsidy to the borrower’s home loan account upfront by deducting it from the principal loan amount. The borrower pays the EMI on the remainder of the principal loan amount.

Login

Login