Stay Up-to-Date with Our

Blogs & Articles

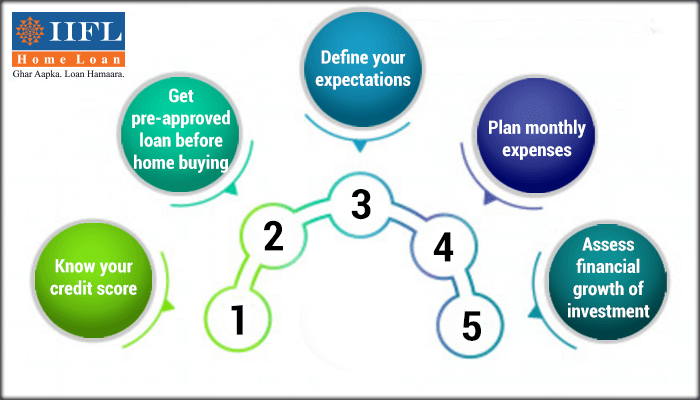

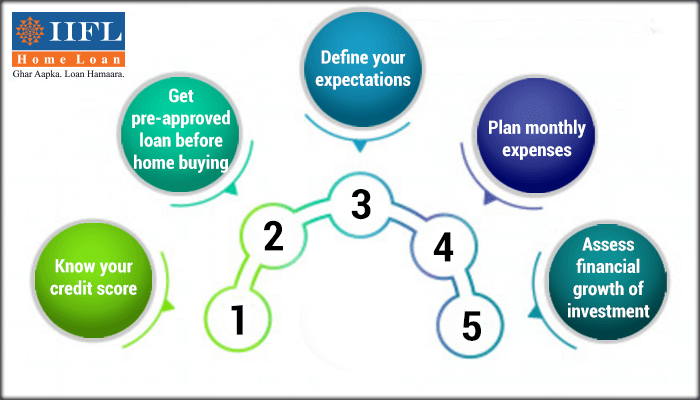

Five Things to Know Before Home Buying

Buying a home is a long and tiring process. Considering its prominent place in the ood, clothing and shelter trio, purchasing a house is one of the most cherished dreams of an individual. Most people would spend their entire life savings just to have a place they can call home. But, however emotional it may be, it is a huge financial leap and you need to think well before taking it.

Here are 5 things that you definitely need to know before you buy a house:

- Know your credit score:

First and foremost is to know your credit score. Buying a home is a costly affair and chances are that you might need external financing in the form of a home loan. First thing that the lenders would look at is your credit score. It not only decides how much loan you are eligible for but also the terms and interest rate would it be. Having a good credit score can save you a huge sum while buying your home. Depending on which range your credit score is, you can negotiate with your broker accordingly.

| Credit Score | How is it |

| 300-550 | 300-550 |

| 551-650 | Bad |

| 651-700 | Fair |

| 701-750 | Good |

| 751 and above | Excellent |

- Get pre-approved before buying a home:

Once you are sure about your financial situation, you can get yourself re-approved by your lender. This assures your broker or agent or seller that you can purchase the property right away without much delay of paperwork or other financing formalities. This becomes extremely helpful if the property you choose has multiple buyers interested in it and being pre-approved gives you an added advantage over them.

- Define your expectations:

Not many people in today times buy a home to sell it immediately. Especially if it is their first home. So if you are buying a place, have a list of expectations written down. This will not only help you narrow your house-hunting but also get you deals that are just ideal for you. Expectations with respect to surroundings, locality, amenities, transportation, access to leisure, entertainment and essential services are some of the things that you need to consider. Share this with your real estate agent so that they refer you the homes that fit these expectations and budget too.

- Know how much you will spend on a monthly basis:

Your monthly payment is also something that you need to consider right at the start. This would include a part of your loan principal and interest amount, property tax, home insurance, tax documents, and other legal paperwork. It would also include things like your water bill, electricity bill, cable bill, internet expenses and gas and other general maintenance costs that you might incur every month. Factor in all these charges and see if it is well within your budget.

- Check for the financial growth of your investment:

Buying a home in a locality that is gaining popularity would ensure that the value of your home is appreciated over time. Check with your agent as well as the locals for the prevailing prices, upcoming developments and scope of value appreciation in the future. This would surely prove to be a blessing in disguise in the long run when you wish to sell and move to another place.

Tags

Latest Blogs

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Recruitment Trends in Housing Finance Sector

Read More

IIFL Home Loans | Feb 05 11:00 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector

Read More

IIFL Home Loans | Feb 05 11:00 AM

Property and Real Estate

Which is Better, a Plot or a Flat?

Read More

IIFL Home Loans | Jan 24 6:30 PM

Property and Real Estate

Five Things to Know Before Home Buying

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Best Cities with Affordable Housing in India

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Best Cities in India to Invest in Real Estate

Read More

IIFL Home Loans | Jan 23 4:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Rent Vs Buy: To Rent or Buy a Home?

Read More

IIFL Home Loans | Dec 19 11:45 AM

Property and Real Estate

Rent Vs Buy: To Rent or Buy a Home?

Read More

IIFL Home Loans | Dec 19 11:45 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Selling your Property? Keep 7 things in Mind

Read More

IIFL Home Loans | Aug 24 12:45 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Some of the Best Places to Invest in Pune

Read More

IIFL Home Loans | Jul 07 2:30 PM

Property and Real Estate

Challenges towards Housing for All by 2022

Read More

IIFL Home Loans | Jul 07 11:15 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Prelude to Building Green - IIFL Home Loan's Guide to Sustainable Affordable Housing

Download reportMost Read Blogs

Property and Real Estate

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Best Cities in India to Invest in Real Estate

Read More

IIFL Home Loans | Jan 23 4:30 PM

Property and Real Estate

Best Cities with Affordable Housing in India

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Challenges towards Housing for All by 2022

Read More

IIFL Home Loans | Jul 07 11:15 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Five Things to Know Before Home Buying

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Property and Real Estate

Recruitment Trends in Housing Finance Sector

Read More

IIFL Home Loans | Feb 05 11:00 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Rent Vs Buy: To Rent or Buy a Home?

Read More

IIFL Home Loans | Dec 19 11:45 AM

Property and Real Estate

Selling your Property? Keep 7 things in Mind

Read More

IIFL Home Loans | Aug 24 12:45 PM

Property and Real Estate

Some of the Best Places to Invest in Pune

Read More

IIFL Home Loans | Jul 07 2:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Which is Better, a Plot or a Flat?

Read More

IIFL Home Loans | Jan 24 6:30 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login

26 views

26 views

0 Likes

0 Likes