Stay Up-to-Date with Our

Blogs & Articles

Real Estate Sector Going Green

Written by Himanshu Arora

Himanshu works as a national head for construction finance & retail home loans at IIFL Home Finance Limited. His deep knowledge and expertise in the sector would help prospective homebuyers make a wise decision. He will not only help us understand how market cycles have again started playing, but also how is this a good time for all the stakeholders of real estate industry developers, housing finance companies and home buyers.

1. What are the considerations for consumer home loans

Consumer home loans is the prime and most focused product, offered by us, where through our varied offerings, we tend to cover largest possible universe. The basic consideration for this product is income and collateral. On income side, we are funding both salaried and business profile clients. On collateral side, we fund builder flats, independent houses and individual properties.

2. What is the impact of sluggish residential sales on housing finance segment

India is a big consumer market and housing is the most basic necessity of people. Although we are noticing sluggishness in housing sector but this can be further split between segments. Here, the high ticket size inventories are facing real heat. Otherwise, affordable housing segment, driven by end user is not that much affected. Therefore, I see upward trend in next few months.

3.Brief on Non-performing assets & mortgages in the current residential real-estate market scenario

On short term basis, with temporarily liquidity problems and low demands, real estate is facing trouble. However, on long term, with new constructive initiatives undertaken by government both on affordable housing and new regulatory norms like RERA, I am hopeful of real estate sector going green from now onwards.

4. Affordable housing is gaining more attention. What are your views on this

ffordable housing has been accredited with nfrastructure status There will be an availability of easy and long term funds to developers. Government has announced Credit Linked Subsidy Scheme under Pradhan Mantri Awas Yojana for Middle Income Group MIG 1 & 11, effective from 01.01.2017. This will increase the number of beneficiaries under the scheme. As per a recent research report, affordable housing finance companies are likely to grow at a CAGR of 40% over the next four years Source: goo.gl/87jikU

5. Please comment on the housing finance sector engagement with real-estate developers

Housing finance sector is getting engaged with real estate developers and using that as a backward integration to their core offering i.e. home loan, this association is mutually rewarding for both. Availed finance will be utilized for the construction of the projects. And, HFCs will fund end users for buying properties.

6. What is the future outlook for housing finance companies in the financial year 2017-18

HFCs can see great business opportunities in new financial year 2017-18, with pricing going down and affordable housing getting push from constructive initiatives of government. With enhanced transparency and regularization of real estate sector, housing finance segment looks more strengthened and positive.

With new constructive initiatives undertaken by government both on affordable housing and new regulatory norms like RERA, I am hopeful of real estate sector going green from now onwards

Tags

Latest Blogs

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

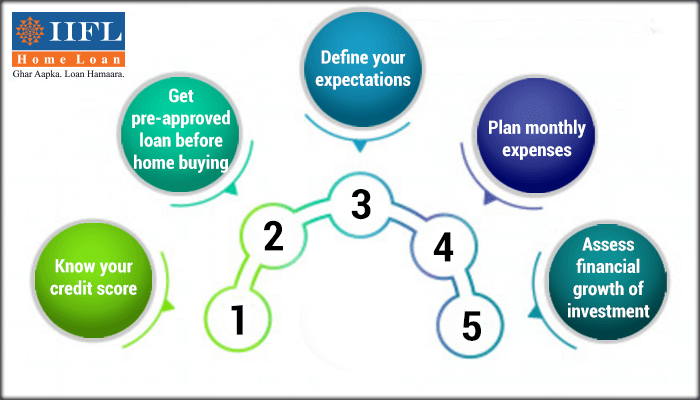

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Recruitment Trends in Housing Finance Sector

Read More

IIFL Home Loans | Feb 05 11:00 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector

Read More

IIFL Home Loans | Feb 05 11:00 AM

Property and Real Estate

Which is Better, a Plot or a Flat?

Read More

IIFL Home Loans | Jan 24 6:30 PM

Property and Real Estate

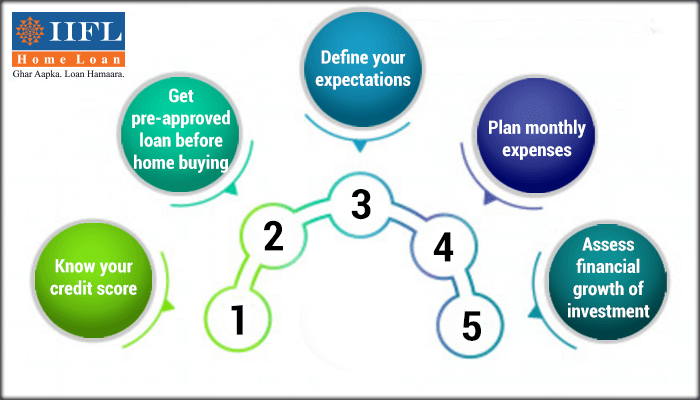

Five Things to Know Before Home Buying

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Best Cities with Affordable Housing in India

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Best Cities in India to Invest in Real Estate

Read More

IIFL Home Loans | Jan 23 4:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Rent Vs Buy: To Rent or Buy a Home?

Read More

IIFL Home Loans | Dec 19 11:45 AM

Property and Real Estate

Rent Vs Buy: To Rent or Buy a Home?

Read More

IIFL Home Loans | Dec 19 11:45 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Selling your Property? Keep 7 things in Mind

Read More

IIFL Home Loans | Aug 24 12:45 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Some of the Best Places to Invest in Pune

Read More

IIFL Home Loans | Jul 07 2:30 PM

Property and Real Estate

Challenges towards Housing for All by 2022

Read More

IIFL Home Loans | Jul 07 11:15 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Prelude to Building Green - IIFL Home Loan's Guide to Sustainable Affordable Housing

Download reportMost Read Blogs

Property and Real Estate

Property and Real Estate

A Quick Guide to Buying a Home for the First Time

Read More

Abhishikta Munjal | Mar 22 6:11 AM

Property and Real Estate

Affordable Housing The Indian Challenge

Read More

IIFL Home Loans | Feb 01 12:00 PM

Property and Real Estate

Affordable Housing: Consumer Movements & Awareness

Read More

IIFL Home Loans | Dec 21 1:00 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Best Cities in India to Invest in Real Estate

Read More

IIFL Home Loans | Jan 23 4:30 PM

Property and Real Estate

Best Cities with Affordable Housing in India

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Buying Your First home? Check these Points

Read More

IIFL Home Loans | Oct 03 2:45 PM

Property and Real Estate

Challenges towards Housing for All by 2022

Read More

IIFL Home Loans | Jul 07 11:15 AM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Five Things to Know Before Home Buying

Read More

IIFL Home Loans | Jan 23 4:45 PM

Property and Real Estate

Guide To Property Registration Process

Read More

IIFL Home Loans | Feb 20 6:15 PM

Property and Real Estate

Property and Real Estate

Have you read home buyer guide?

Read More

IIFL Home Loans | Sep 14 12:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Market Practices On Immovable Property Valuations

Read More

IIFL Home Loans | Oct 04 2:30 PM

Property and Real Estate

More Inflow of Funds in India Real Estate

Read More

IIFL Home Loans | Sep 18 12:45 PM

Property and Real Estate

Property and Real Estate

Read About DDA Aawasiya Yojana 2017

Read More

IIFL Home Loans | Dec 28 12:15 PM

Property and Real Estate

Property and Real Estate

Recruitment Trends in Housing Finance Sector

Read More

IIFL Home Loans | Feb 05 11:00 AM

Property and Real Estate

Recruitment Trends in Housing Finance Sector in India

Read More

IIFL Home Loans | Nov 15 11:15 AM

Property and Real Estate

Rent Vs Buy: To Rent or Buy a Home?

Read More

IIFL Home Loans | Dec 19 11:45 AM

Property and Real Estate

Selling your Property? Keep 7 things in Mind

Read More

IIFL Home Loans | Aug 24 12:45 PM

Property and Real Estate

Some of the Best Places to Invest in Pune

Read More

IIFL Home Loans | Jul 07 2:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Property and Real Estate

Tier II & Tier III Cities- New Face of India

Read More

IIFL Home Loans | Feb 26 1:45 PM

Property and Real Estate

Tips For Hassle-Free Home Buying

Read More

IIFL Home Loans | Jun 28 3:30 PM

Property and Real Estate

Property and Real Estate

Property and Real Estate

Which is Better, a Plot or a Flat?

Read More

IIFL Home Loans | Jan 24 6:30 PM

Property and Real Estate

Why You Should Buy A Second Home?

Read More

IIFL Home Loans | May 23 1:00 PM

Property and Real Estate

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login

26 views

26 views

0 Likes

0 Likes